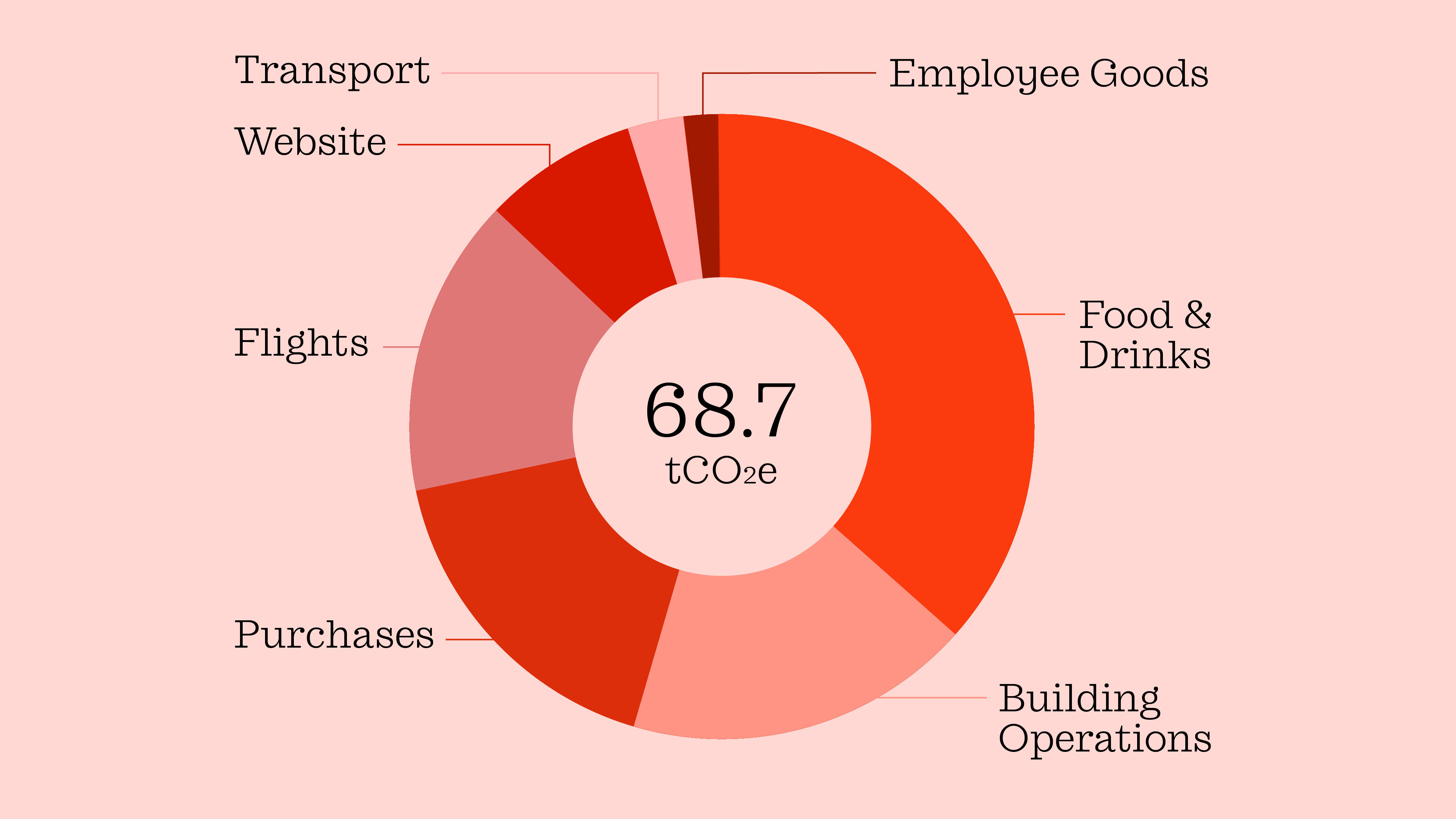

€220 invested per ton CO2 we emitted in 2022. Let's break that down.

Written by

To assess and – even more importantly – manage our climate impact, we have set up a four-step, yearly carbon emissions process. Calculate, reduce, remove, repeat. It so happens that we have reached our yearly ‘removal’ stage, which means we look towards balancing our carbon emissions equation. By a 1-to-1 investing approach for carbon removal, we effectively remove the same amount of carbon emissions from the atmosphere as we have emitted*.

“

We have the highest ambitions on behalf of our clients. So, naturally, we also set the highest ambitions for ourselves.

Johan, CEO & Partner

We are already in 2030.

How do we decide how much to invest? Inspired by Klimarådet, Denmark’s Climate Council, we have decided to self-impose a financial charge for our unavoidable emissions, also known as €/tCO2e. We started last year at an €82/tCO2e-level with an ambition to gradually increase the charge towards Klimarådet’s recommended €202/tCO2e charge for 2030. But, when the time came to decide on this year’s self-imposed charge, we decided to commit to a €220/tCO2e charge already now, going beyond both our own and Klimarådet’s aspirations.

“

Our self-imposed €220/tCO2 charge was initially our goal for a couple of years into the future. But why wait? It is evident that climate change mitigation is urgent. We want to act with the same sense of urgency.

Johan, CEO & Partner

Why do we pay such a relatively high charge, especially when it is self-imposed? For us, it's quite simple. The multitude of negative impacts caused by climate change is, by now, no surprise to most of us. But although sustainability, ‘green’ economy, decarbonisation, ESG, and all the related buzzwords are becoming more and more integrated with our daily lives, and climate mitigation seems to become more of an active fact than ambition, the urgency of our climate crisis seems to be ever-increasing. It is no longer global warming, nor even global heating — we are facing a global “boiling” if we do not become more climate change resilient. What on Earth (yes, pun intended) can we do?

“

In our efforts to become increasingly conscious of our impact and become more mindful of our resource usage, we explore where we can and push beyond our own aspirations. The more we learn the more nuanced our decision-making processes and operations become.

Nanna, Impact Analyst

We have the answer and the technologies, but decarbonising our global economy and societies requires significant investment. More specifically, it requires $3.5 – $4+ trillion in investments. That’s why we at Kontrapunk self-impose a financial charge for every ton of CO2e we emit annually and channel this pool of money towards carbon removal projects.

Carbon removal isn't just about cleaning up our mess; it's about speeding up the arrival of a decarbonised future.

Our investments are driven by the desire to propel the development and adoption of technologies that can expedite the transition to an inclusive, decarbonised economy. That’s why the projects we back don't just remove carbon; they bring many benefits to the table — ecological, social, and economic.

With sharp guidance from carbon-removal company Klimate, we have bought a portfolio consisting of four diverse carbon removal projects across three continents. A deep dive into these projects, technologies, and their beneficial impact will come in October - be sure to check back in.

*Now, although these emissions are unavoidable - we are turning every stone we can to reduce them as much as possible. But as not all of our resources can be sourced emissions-free (yet), we are left with a remaining, unavoidable carbon emission footprint. Reducing emissions is the backbone of global decarbonisation and net-zero scenarios - however, reducing carbon emissions globally will, by most projections, not happen in time for 2050 as per the Paris Agreement. Hence, scaling of carbon removal methods will be a necessary supplementary method for reaching our decarbonisation goals in time.

Want to talk about impact? Don't hesitate to reach out.